The Bull Market has a better taste with this condition

If macroeconomic conditions are favorable, cryptocurrencies are better and the bull market is only better or more intense. However, if optimal conditions have often been fulfilled since the start of bitcoins and the first cryptocurrencies, in fact, this has not been from the bear market 2022.

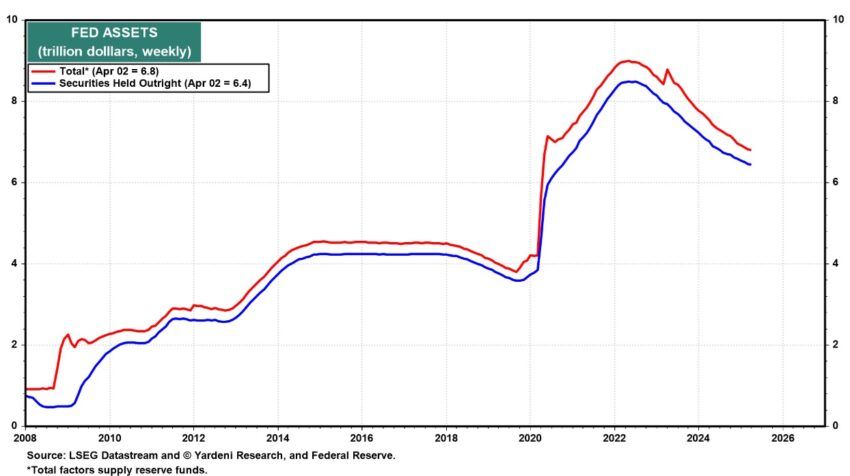

As the analyst Crypto Miles Deutscher emphasizes, the best bull market is formed for BTC and risky assets when we are in full QE. According to QE, the analyst concerns the quantitative release of the appeal that corresponds to the period contributing to risky investments. And for a good reason, the central bank or entity that has this role (status Fed), liquidity in circulation, reduces interest rates and supports the country’s economic activity in its entirety to revive the maximum economy. It is generally a policy that is implemented in times of crisis or too slight growth.

According to Miles Deutscher, even though the crypto market has experienced positive moments without QE access, which Fed has set, this is at this exact moment when the best time begins for the bull market. This is especially what happened during the previous Haussier market, with QE policy, which began in response to COVI-19 crisis. It was an incredible catalyst for the bull market with two peaks of 2021.

After that, however, as a result of the gallop inflation, the American Fed decided to gradually increase interest rates and stop this QE policy. On the contrary, it is created a strategy called QT (quantitative firm). This approach is generally against the QE strategy, with a Fed that seeks to get rid of its assets to reduce money supply in circulation. Therefore, money in the economy changes less, which contributes less to risky investments. Especially because investors are no longer euphoric with uncontrollable inflation and economic uncertainty.

Unfortunately, this strategy has begun for a crypto on the bull market during 2022 (bear market), with the first increase in interest rates and money supply in circulation for a decline. Since 2022, the Fed continued to separate from liquidity with a continuous decline. Despite everything, after the painful episode of 2022, bitcoins and some cryptocurrencies could still recover. However, the excellent bull market has nothing to do with what happened before.

To do this, the QE policy will have to be established by the Fed. With a well -marked decrease in inflation, the problems should not persist for too long for cryptocurrencies.

Morality History: The Bull Market is like a good cook, the secret of the bowl is always well preserved.

Notification of irresponsibility

Notice of irresponsibility: In accordance with the Trust project Directives, this article for price analysis is intended only for information purposes and must not be considered financial or investment advice. Beincrypto undertakes to provide accurate and impartial information, but market conditions may change without prior notice. Always carry out your own research before making any financial decision and consult a professional.